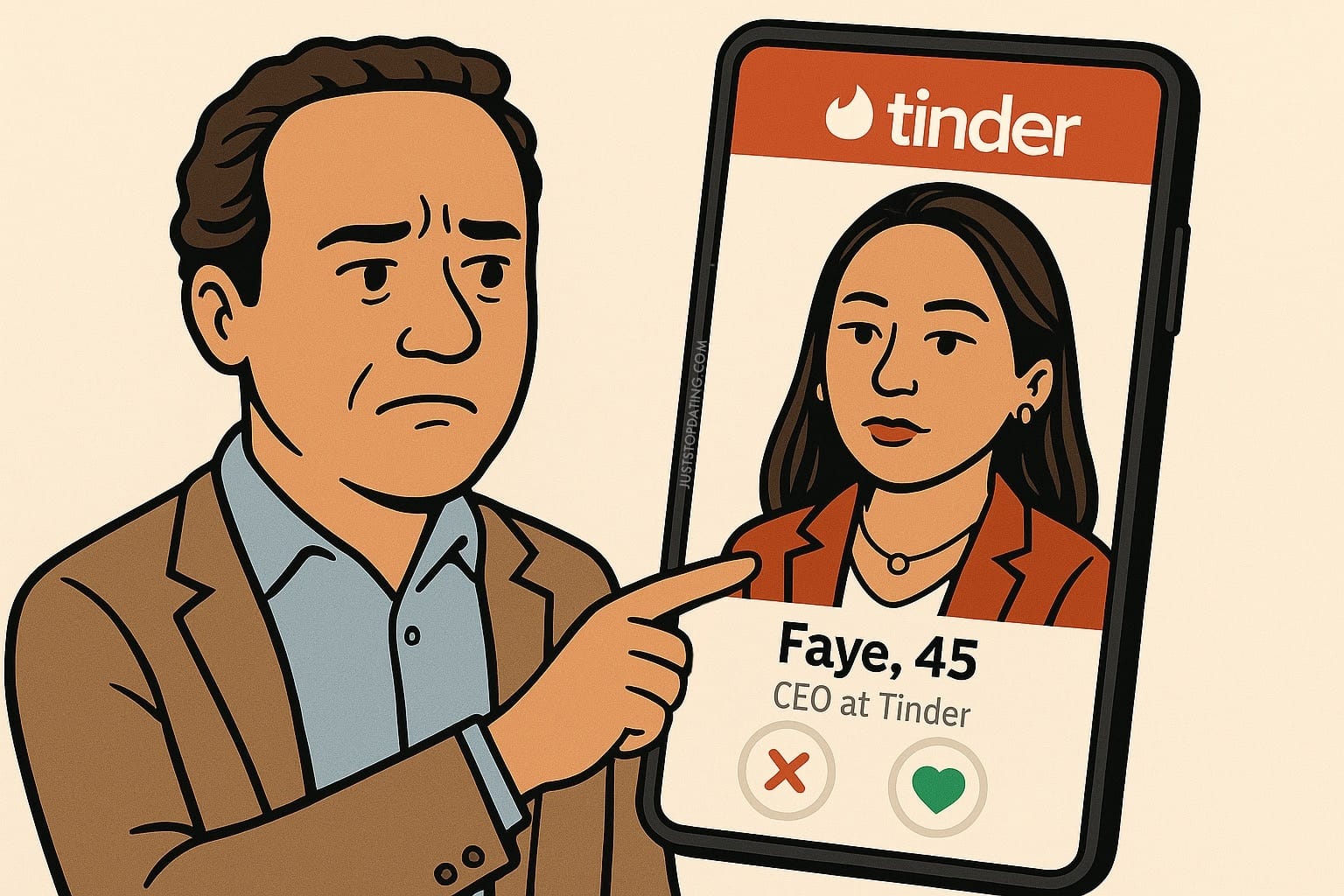

Former CEO Faye Iosotaluno’s Tinder Tenure

Iosotaluno’s short time as CEO was marked by specific achievements and acknowledgments of past mistakes. In February 2024, she made headlines by admitting Tinder had “dropped the ball” on women’s experiences (Fortune, 2024), signaling a significant shift in the app’s approach to user safety and engagement. She was brought in specifically to help lead Tinder’s efforts to improve user growth and retention, particularly among women and younger users (Los Angeles Business Journal, 2024).

Under her leadership, Tinder redefined its brand through award-winning marketing work, introduced friend-focused features that broke from old paradigms, and doubled down on personalization by further integrating AI into recommendations (Reuters, 2025). According to the Match Group, Tinder’s direct revenue in 2024 grew by approximately 1% year-over-year, reaching around $1.9 billion. This growth was primarily driven by an 8% increase in revenue per payer, which offset a 7% decline in the number of paying users .

Despite the slight revenue uptick, Tinder encountered a 10% decline in daily active users in 2024, indicating challenges in maintaining user engagement . These issues contributed to Iosotaluno’s decision to step down as CEO in July 2025. Her departure was part of broader executive changes at Match Group, which included a 13% workforce reduction aimed at streamlining operations and revitalizing growth. As of the first quarter of 2025, Match Group has reported a 5% fall in paying users (Reuters, 2025).

Rascoff’s New Approach to Save Tinder? Layoff the Workforce

Spencer Rascoff, Match Group’s CEO since February, will step in to lead the Tinder team during this transition (Reuters, 2025). But Rascoff’s track record tells a complex story of both remarkable achievements and significant failures.

At Zillow, Rascoff built an impressive empire: he scaled the company to over 4,500 employees, $3 billion in revenue, and a $10 billion market capitalization (Match Group, 2025), leading Zillow through its 2011 IPO and 15 acquisitions. He was even named “The Most Powerful Person in Residential Real Estate” by the Swanepoel Power 200 in 2017.

However, Rascoff’s Zillow story ended controversially. He was pushed out as CEO in February 2019, setting the stage for co-founder Rich Barton to re-assume leadership. The move was widely seen as a bid to win investors’ backing for the company’s plan to buy homes and originate mortgages through iBuying (Yahoo Finance, 2025) a strategy Rascoff had championed but that ultimately proved disastrous.

Rascoff had said “I bet the company of Zillow on the shift to iBuying,” and the company hired “thousands of employees” to facilitate the new strategy. The gamble failed spectacularly as Zillow was losing about $5,000 per home sale on average in 2019 after holding costs, selling costs, and interest expenses were factored in (Wall Street Journal, 2021). The iBuying division was ultimately shuttered entirely in 2021, with Zillow laying off 25% of its staff.

Notably, Rascoff also faced a dark moment early in his career when hijackers used his startup Hotwire to purchase their 9/11 tickets, leading to “an awful sense of guilt” (CSQ, 2022) and significant business challenges.

Now Rascoff faces a different kind of turnaround challenge. He’s already demonstrated his aggressive approach at Match Group: cutting 13% of the workforce (about 325 employees) while promising to “light a fire under the team” (Fortune, 2025) to accelerate product development and reduce management layers.

Welp! The Dating App Industry was Doomed Anyway

The dating app industry experienced artificial growth during the COVID-19 pandemic that created unsustainable valuations. Tinder broke its record for the most activity in a single day on March 29, 2020, with more than 3 billion swipes, while OkCupid saw a 700% increase in dates between March and May 2020 (Wiederhold, 2021). Online dating site subscribers worldwide spent more than $4.2 billion in subscriptions in 2021, representing a 30% increase over 2020 (Newsweek, 2022). This explosive growth created inflated expectations and valuations that proved impossible to maintain once social restrictions lifted and users returned to in-person activities.

Economic Pressures and Inflation Impact

Rising costs significantly impacted dating behavior and app monetization. Inflation in the U.S. hit 9.1% in June 2022, the highest increase in four decades, with full-service restaurant prices rising 8.9% (Newsweek, 2022). This economic pressure directly affected dating app users, with 41% of Hinge users reporting they were more concerned with dating costs compared to a year prior due to inflation (Newsweek, 2022). Users began cutting back on premium subscriptions and expensive first dates, reducing the revenue potential for dating platforms.

Swipe Fatigue and Choice Overload

Dating apps created fundamental psychological problems for users. The endless swiping led to what psychologists call the “paradox of choice,” where too many options make users unable to commit to one person, always wondering if a better match is just another swipe away. This abundance of choice often resulted in dissatisfaction and regret, transforming the search for love from a joyful pursuit into a frustrating chore.

Dehumanization of Dating

Many platforms encouraged a superficial approach to dating, where users judge others based on a few photos and a brief bio, leaving many feeling disconnected and dehumanized. This gamification of romance created engaging initial experiences but ultimately left users feeling unsatisfied with the quality of connections they were making.

The Dating App Paradox

Companies like Hinge market themselves as “designed to be deleted,” creating a fundamental contradiction between their social mission of helping people find love and their business mission of keeping users paying for subscriptions (NPR, 2024). This creates an inherent tension in their business model where success for users (finding lasting relationships) potentially conflicts with business success (retaining paying subscribers). Their Chief Marketing Officer Nathan Roth stated that Hinge deliberately opposed “digital addiction” by encouraging people to meet in real life and get off the app as quickly as possible (Rogers, 2019).

Despite the messaging, Hinge has succumbed to the same monetization pressures as other apps. Users reported that the free version of Hinge is “absolute trash” with desirable matches placed “behind a paywall” to drive premium subscriptions (NPR, 2024). This suggests Hinge hasn’t actually solved the fundamental tension between helping users find love and maintaining a profitable business model.

Market Saturation and Competition

The market became increasingly fragmented with niche apps catering to specific demographics gaining traction, making it harder for any single app to maintain dominance. This fragmentation diluted market share among major players while increasing customer acquisition costs across the industry.

Return to In-Person Dating

There’s a growing trend toward “intentional dating” and in-person connections, with singles abandoning apps to search for love as their parents and grandparents once did in person (Fluker, 2025). Singles are increasingly looking toward in-person connections for dating, with services like speed dating becoming more popular as people seek authentic chemistry that cannot be determined through photos and brief bios.

Bottom Line

The leadership change represents more than musical chairs; it’s a bet that Rascoff’s aggressive restructuring playbook can succeed where his previous “moonshot” mentality failed. While he built Zillow into a real estate giant, his overconfidence in algorithmic home-flipping cost the company billions and thousands of jobs. The question now is whether his pattern of bold bets and rapid scaling can revive Tinder without repeating past mistakes.

Given that dating apps face fundamentally different challenges than real estate requiring sustained user engagement rather than transaction volume Rascoff’s approach will need significant restructuring. For a company built on “helping people” find meaningful connections, the irony isn’t lost: Match Group itself seems to be searching for the right relationship between leadership vision and execution reality. Good luck.