The Hidden Financial Chains of Infidelity

Infidelity can destroy financial stability sinking unsuspecting victims in debt beyond their wildest imaginations, making it harder for betrayed partners to leave. The financial damage creates that are invisible to the naked eye but visible to you and those around you when they see the pain that financial strain has caused you.

Affairs are expensive endeavors cheaters are paying for hotels, dinners, gifts, and sometimes even child support for an affair baby in rare cases. What’s more concerning is that financial infidelity typically accompanies emotional and physical cheating, as secrecy in one area naturally extends to another.

The Financial Prison: By the Numbers

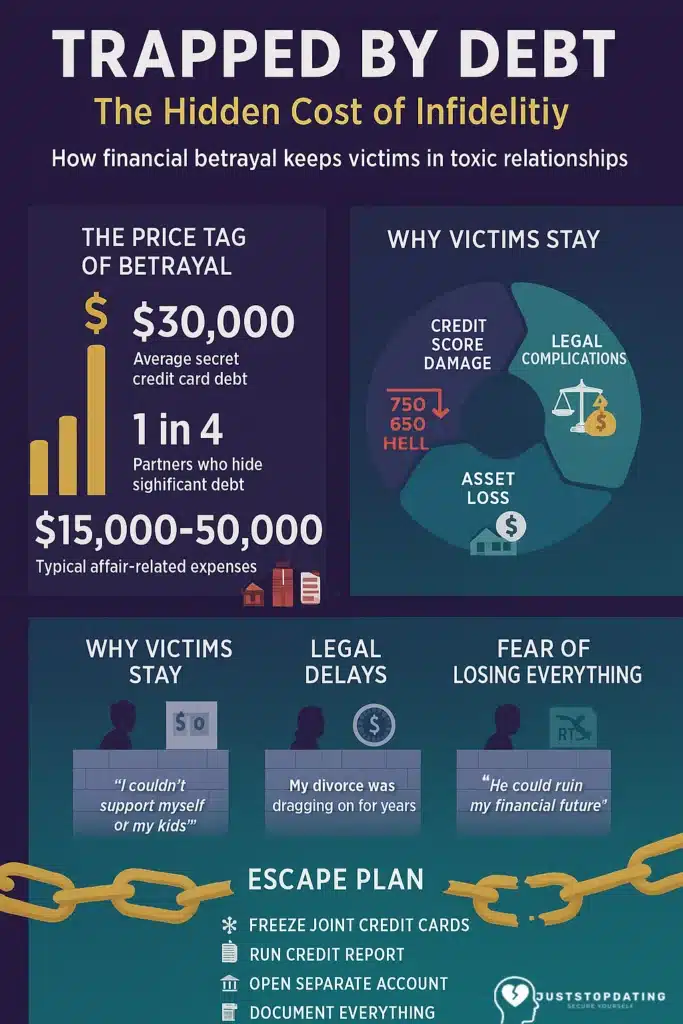

When it comes to how much debt cheaters accumulate, the numbers are staggering. Documented legal cases show partners discovering anywhere from $30,000 in secret credit card debt for affair-related expenses like hotels and gifts, while surveys from Debt.com revealed that 1 in 4 people admitted to “racking up debt without their partner’s knowledge” through hidden credit cards and cash advances. This financial betrayal creates multiple types of emotional and financial debt. First, there’s the immediate damage to credit scores when payments are missed or joint accounts are maxed out.

As one victim shared online, “My wife’s $30k debt dropped our credit score by 150 points and now we can’t refinance our mortgage.”

Legal complications follow, as marital debt is often split 50/50 in divorce, even when one spouse secretly accumulated it. Proving financial infidelity typically requires expensive forensic accounting, putting it beyond reach for many victims.

Why “Just Leave” Isn’t Simple

The most devastating aspect of financial infidelity is how it creates dependency. Many victims who are often stay-at-home parents have no access to separate funds.

As one survivor shared, “I stayed in that relationship 3 more years than I should have because I had no job or savings.”

Even when victims are ready to leave, the legal system moves frustratingly slowly. Debts continue piling up while waiting for settlements, with many cases of ex-partners dragging out divorce proceedings while still spending on joint accounts. The fear of losing everything keeps many victims trapped. There are documented cases of cheating spouses draining retirement accounts and liquidating investments to fund their affairs. One victim reported, “He took $50k from our 401(k) to fund his affair. Now, I have to work 10 extra years.”

Protecting Yourself Financially in Toxic Relationships

If you suspect financial infidelity, take these immediate steps:

- Freeze joint credit cards by contacting the issuer

- Run a credit report through AnnualCreditReport.com

- Open a separate bank account and begin moving money quietly

- Consult a divorce lawyer, even if you’re considering reconciliation

If you’re already dealing with affair-related debt:

- Document everything, including bank statements and evidence of hidden accounts

- Consider filing for legal separation to prevent new marital debt

- Look into debt consolidation options (while being cautious of potential scams)

Beyond Bad Money Habits, It’s Financial Abuse

Financial infidelity, also referred to as marital financial deception (MFD), is a form of deception or dishonesty within a committed relationship where one partner hides or misrepresents financial information from the other (Dew et al., 2022). Unfortunately, legal systems, worldwide but especially in the United States of America, are slow to recognize financial abuse compared to more visible forms of mistreatment. However, in states such as California, Maryland, New York, South Carolina, and Texas, financial abuse is considered domestic abuse. Currently, only nine states classify extreme financial infidelity as abuse (Table 1).

| State | Recognizes Financial Infidelity as Abuse? | Notes |

|---|---|---|

| California | Yes | Includes economic abuse in domestic violence laws |

| Illinois | Yes | Financial control recognized as form of abuse |

| Maryland | Yes | Includes financial control in protective orders |

| Massachusetts | Yes | Coercive financial control recognized |

| New Hampshire | Yes | Includes economic abuse in domestic violence statutes |

| New York | Yes | Economic abuse grounds for protection orders |

| South Carolina | Yes | Financial control included in abuse definitions |

| Texas | Yes | Economic abuse recognized in family violence code |

| Washington | Yes | Coercive control including financial abuse recognized |

| All Other States | No | Financial infidelity not specifically classified as abuse |

Table 1. U.S. States That Recognized Financial Infidelity as Domestic and/or Economic Abuse. The table highlights a critical gap in legal protections for victims of financial infidelity which is a form of betrayal where one partner secretly racks up debt, hides assets, or manipulates finances to control the other. Currently, only nine states explicitly classify extreme financial infidelity as a form of economic abuse, meaning victims in most of the U.S. have limited legal recourse.

Held Hostage by The Financial Damage of an Affair

The financial damage from affairs varies widely. On the lower end, victims discover $5,000–10,000 in hidden shopping and small lies. Affairs typically generate between $15,000–50,000 in secret debt from hotels, gifts, and trips. In extreme cases, victims have discovered over $100,000 in hidden debt from gambling, secret loans, or business failures. The result? Many victims remain financially hostage, unable to leave because repairing credit takes years, and divorce proceedings don’t always eliminate the financial damage.

Resources for Breaking Free

If you need help, contact the National Domestic Violence Hotline for financial abuse support at 1-800-799-7233. For rebuilding your credit, the FTC offers guidance at ftc.gov/credit.

Remember: Financial freedom after infidelity and toxic relationships is possible, but it requires careful planning and support. The first step is recognizing that financial infidelity isn’t your fault and you deserve better.